And since some SDIRAs for example self-directed traditional IRAs are topic to expected bare minimum distributions (RMDs), you’ll need to prepare in advance making sure that you may have ample liquidity to satisfy The foundations set through the IRS.

Increased Charges: SDIRAs often feature bigger administrative fees as compared to other IRAs, as specified components of the executive process can't be automated.

An SDIRA custodian differs given that they have the suitable workers, abilities, and capacity to maintain custody of your alternative investments. The first step in opening a self-directed IRA is to find a supplier that is definitely specialized in administering accounts for alternative investments.

Selection of Investment Selections: Make sure the service provider permits the types of alternative investments you’re keen on, for instance real estate, precious metals, or private fairness.

Should you’re searching for a ‘set and ignore’ investing method, an SDIRA probably isn’t the best preference. As you are in complete Handle about every investment manufactured, It is your decision to execute your very own due diligence. Bear in mind, SDIRA custodians are certainly not fiduciaries and cannot make tips about investments.

Better investment choices indicates you are able to diversify your portfolio over and above shares, bonds, and mutual money and hedge your portfolio from market place fluctuations and volatility.

Imagine your friend may very well be starting off the following Facebook or Uber? With the SDIRA, you could put money into will cause that you think in; and perhaps get pleasure from increased returns.

Opening an SDIRA can provide you with use of investments Commonly unavailable through a financial institution or brokerage firm. Listed here’s how to begin:

Put just, in the event you’re trying to find a tax effective way to develop a portfolio that’s a lot more tailored towards your passions and know-how, an SDIRA may very well be The visit here solution.

IRAs held at banking companies and brokerage firms supply minimal investment choices to their consumers because they don't have the skills or infrastructure to administer alternative assets.

Property is among the preferred selections among SDIRA holders. That’s simply because it is possible to put money into any type of property by using a self-directed IRA.

Being an Trader, nonetheless, your options are certainly not restricted to shares and bonds if you decide on to self-immediate your retirement accounts. That’s why an SDIRA can remodel your portfolio.

Including cash directly to your account. Keep in mind that contributions are subject to once-a-year IRA contribution boundaries set by the IRS.

As a result, they have an inclination not to market self-directed IRAs, which provide the flexibility to take a position inside of a broader array of assets.

Have the liberty to invest in Nearly any kind of asset having a danger profile that matches your investment technique; which include assets that have the potential for a better level of return.

At times, the fees affiliated with SDIRAs could be better and even more complex than with an everyday IRA. It's because of the enhanced complexity affiliated with administering the account.

Yes, real-estate is one of our purchasers’ most widely used investments, in some cases identified as a property IRA. Clientele have the choice to take a position in almost everything from rental Homes, industrial real-estate, undeveloped land, mortgage notes plus much more.

This consists of understanding IRS restrictions, running investments, and averting prohibited transactions that might disqualify your IRA. A lack of data could bring about costly faults.

Buyer Guidance: Search for a company which offers dedicated assist, together with access to well-informed specialists who will answer questions about compliance and IRS procedures.

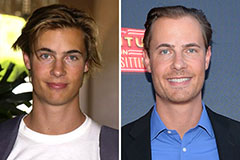

Erik von Detten Then & Now!

Erik von Detten Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!